SCS

0.0200

Wall Street stocks slid on Wednesday as the US government started to shut down after Democrats and President Donald Trump failed to break a deadlock over spending.

The prospect of services in the United States being closed pushed gold to another record high over $3,895.

The blue-chip Dow gave up 0.2 percent in opening deals, the broader S&P 500 shed 0.4 percent and the tech-heavy Nasdaq Composite declined 0.6 percent.

"There have been previous shutdowns, and typically these have had little effect on financial markets. But much depends on how long the shutdown lasts," said David Morrison, analyst at Trade Nation.

"Given the current intransigence on both sides, there's a possibility that federal services could be curtailed for some time," he said.

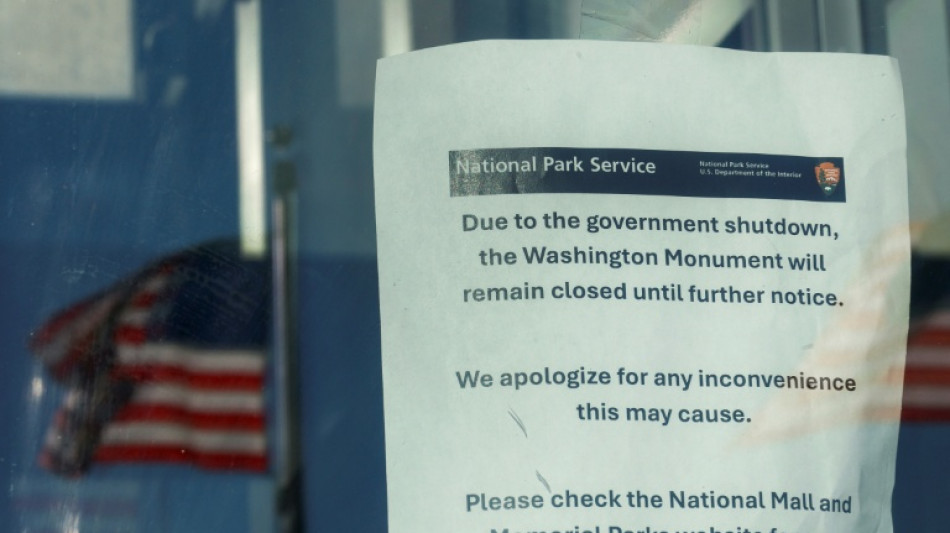

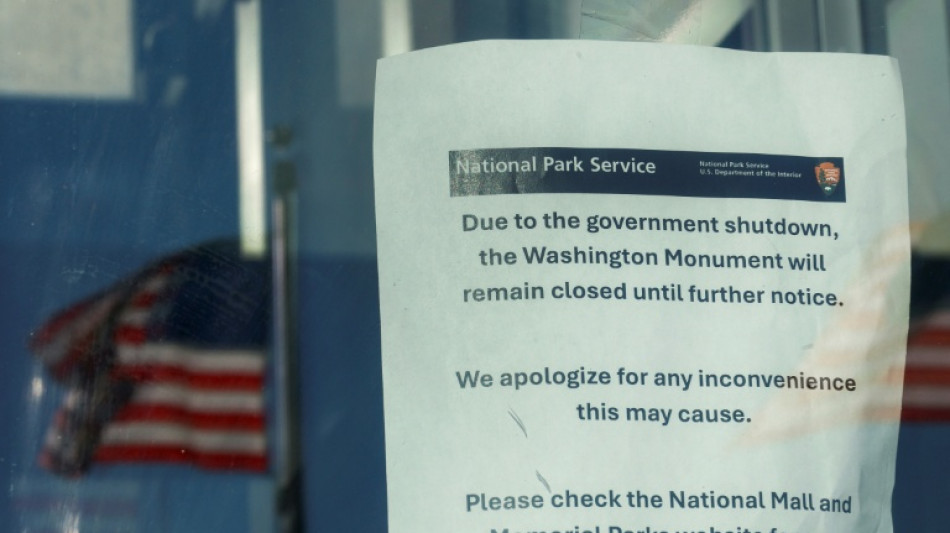

Government operations began grinding to a halt at 12:01 am (0401 GMT) Wednesday after Republicans and Democrats failed to break an impasse in Congress.

The closure will see non-essential operations halted, leaving hundreds of thousands of civil servants temporarily unpaid, and many social safety net benefit payments potentially disrupted.

Analysts say negative impacts from closures can be reversed once the government reopens.

"Investors have been willing to ignore a lot of inconvenient facts for the past several months or even years," said Steve Sosnick, of Interactive Brokers. "So they might do the same again."

Investors were also digesting data from payroll firm ADP showing the US private sector lost 32,000 jobs in September, despite analysts' expectations of employment growth.

"This is another sign that the US labour market is losing steam," said Kathleen Brooks, research director at XTB trading platform.

"This one is worrying, it is the third time in four months that the private sector has shed jobs, which comes after a boom in service sector jobs growth post Covid," she said.

Analysts said the weaker jobs market cement expectations that the US Federal Reserve will cut interest rates twice more this year after lowering borrowing costs last month for the first time since December.

Investors are concerned the US government shutdown could prevent the release Friday of the key non-farm payrolls report -- a crucial data point for the Fed on rate decisions.

The dollar remained under pressure on concerns over the shutdown as well as the prospect of more interest rate cuts, which make the currency less attractive to investors.

European markets were lifted by pharmaceutical shares after Pfizer was granted reprieve from Trump's tariffs by agreeing to lower drug prices in the United States.

Shares in British pharma giant AstraZeneca rose more than eight percent and GSK was up over four percent in London.

In Asia, Tokyo's stock market sank, while Hong Kong and Shanghai were closed for holidays.

- Key figures at around 1330 GMT -

New York - Dow: DOWN 0.2 percent at 46,309.42 points

New York - S&P 500: DOWN 0.4 percent at 6,659.34

New York - Nasdaq Composite: DOWN 0.6 percent at 22,526.38

London - FTSE 100: UP 0.8 percent at 9,422.24

Paris - CAC 40: UP 0.7 percent at 7,952.67

Frankfurt - DAX: UP 0.6 percent at 24,029.38

Tokyo - Nikkei 225: DOWN 0.9 percent at 44,550.85 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: UP at $1.1755 from $1.1739 on Tuesday

Pound/dollar: UP at $1.3518 from $1.3448

Dollar/yen: DOWN at 146.67 yen from 147.86 yen

Euro/pound: DOWN at 86.97 pence from 87.29 pence

West Texas Intermediate: DOWN 0.9 percent at $61.80 per barrel

Brent North Sea Crude: DOWN 0.9 percent at $65.43 per barrel

burs-rl/lth

N.Kratochvil--TPP