CMSC

0.0000

Equities jumped Thursday after data showing job losses in the US private sector fanned optimism for more interest rate cuts and overshadowed a partial shutdown of the country's government.

Tech firms led the way higher as a deal between South Korea's biggest chip firms and OpenAI added fuel to the AI-led rally that has helped push markets to record highs.

While debate rages over the impact of the closure of some US departments owing to a standoff between lawmakers in Washington, investors continue to focus on the outlook for more Federal Reserve rate cuts.

And hopes were given a boost Wednesday by figures from payrolls firm ADP showing companies shed 32,000 posts last month, confounding forecasts for a gain of more than 50,000.

The data was the latest in a string of below-par reports indicating the labour market in the world's top economy continues to slow and will give more impetus for the Fed to cut rates twice more before the end of the year.

Observers said the reading had a little more significance owing to expectations that crucial non-farm payrolls statistics will not be released as usual on Friday owing to the shutdown.

"The market is going to have to focus on independent private sources to get a sense of what's going on," Wellington Management's Brij Khurana said.

"If the administration does go forward with cutting headcount, there is potential for this to have an economic impact and probably more so than what we're used to."

Economists at Bank of America wrote before the release: "Some downside risks remain on the horizon for labour demand. Goods producing sectors have been shedding jobs since May, in part due to tariff uncertainty.

"Also, we expect to see continued layoffs in the professional and business services sector, where AI adoption is presumably relatively faster."

They added that recent government layoffs by Donald Trump's administration would also weigh.

After all three main indexes on Wall Street rose, with the S&P 500 and Nasdaq hitting records, Asia was happy to take up the baton.

Tokyo, Sydney, Singapore, Wellington, Bangkok, Manila and Jakarta were all up, with Hong Kong piling on more than one percent as traders returned from a midweek break. Shanghai is closed for a week-long holiday.

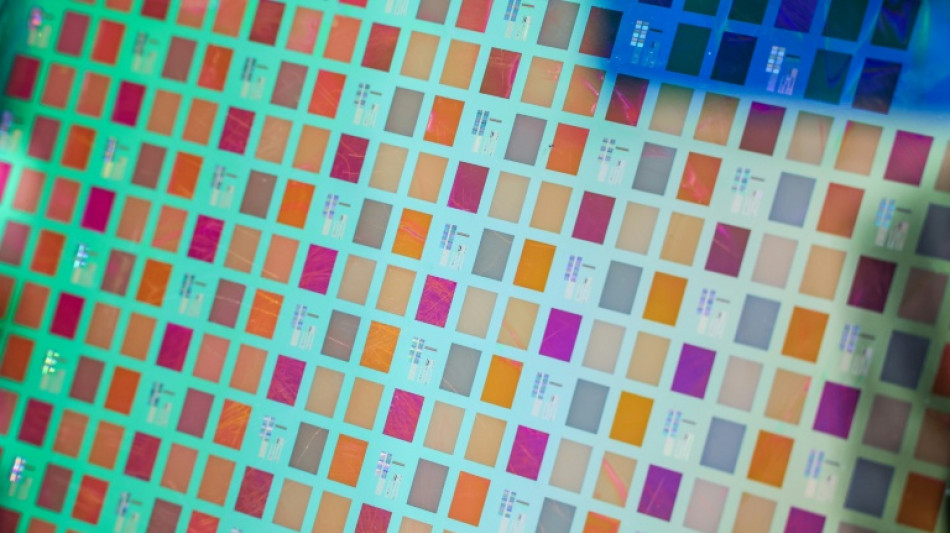

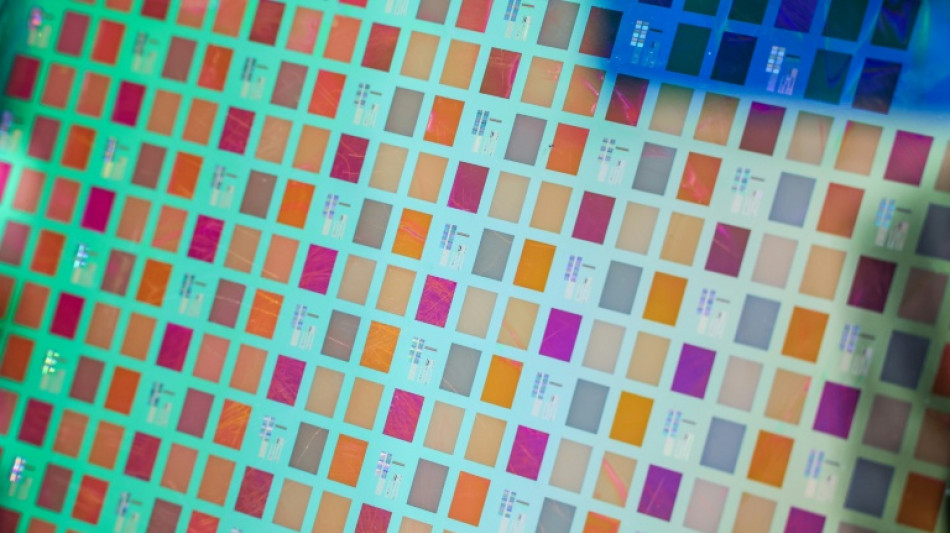

But Seoul and Taipei led the rally thanks to a boost in chip firms following news of the deal between OpenAI and Samsung and SK hynix.

The Korean firms said they had signed preliminary deals with the US company to provide chips and other equipment for its Stargate project, during a visit to Seoul by OpenAI chief executive Sam Altman.

SK hynix soared around 12 percent at one point and Samsung around five percent, helping the Kospi index to add 2.7 percent to a record high.

Taipei's TAIEX index jumped 1.5 percent as chip titan and market heavyweight TSMC piled on three percent.

Other regional tech firms also enjoyed a run-up, with Hong Kong-listed Alibaba, Tencent and JD.com all up between two and four percent.

Tech companies have been at the forefront of a surge across markets this year as investors pile into all things linked to artificial intelligence, with hundreds of billions being pumped into the sector.

London, Paris and Frankfurt opened with healthy gains.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 0.9 percent at 44,936.73 (close)

Hong Kong - Hang Seng Index: UP 1.9 percent at 27,363.39

Shanghai - Composite: Closed for a holiday

London - FTSE 100: UP 0.2 percent at 9,465.92

Euro/dollar: UP at $1.1737 from $1.1728 on Wednesday

Pound/dollar: UP at $1.3480 from $1.3476

Dollar/yen: UP at 147.22 yen from 147.14 yen

Euro/pound: UP at 87.07 pence from 87.04 pence

West Texas Intermediate: UP 0.2 percent at $61.89 per barrel

Brent North Sea Crude: UP 0.2 percent at $65.45 per barrel

New York - Dow: UP 0.1 percent at 46,441.10 (close)

V.Nemec--TPP