SCS

0.0200

Equities jumped Thursday thanks to gains in tech stocks and as weak US jobs data fanned optimism for more interest rate cuts, outweighing concerns over a partial government shutdown.

Paris and Frankfurt stock markets jumped more than one percent, with automakers also rallying.

London was flat.

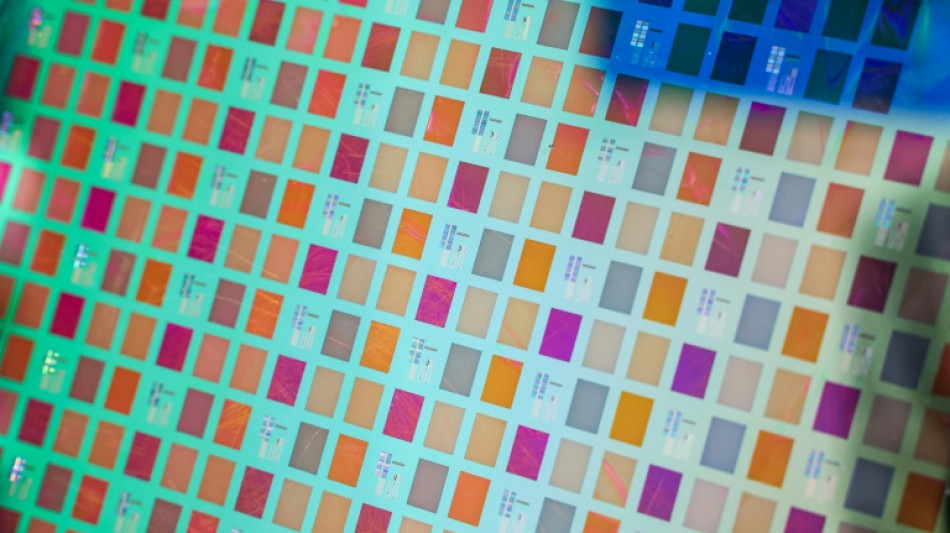

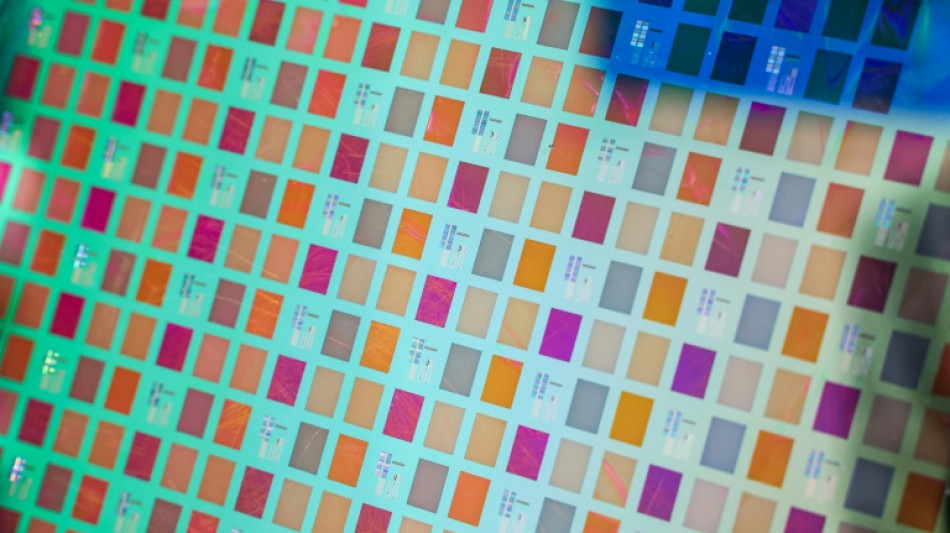

Tech stocks surged as South Korea's biggest chip firms agreed to supply chips and other equipment to OpenAI's Stargate project for AI infrastructure.

South Korea's Kospi index climbed 2.7 percent to a record high, thanks to Samsung and SK Hynix shares soaring to one-year highs after the firms signed a preliminary deal with the ChatGPT developer OpenAI.

Tokyo rose, as did Hong Kong's tech-heavy Hang Seng index. Shanghai was closed for a week-long holiday.

Taipei's stock index jumped 1.5 percent as chip titan and market heavyweight TSMC piled on three percent.

Europe's tech companies also rose, with ASML up five percent, and STMicroelectronics and Schneider Electric adding more than two percent.

Tech companies have been at the forefront of a surge across markets this year as investors pile into all things linked to artificial intelligence, with hundreds of billions being pumped into the sector.

The valuation of OpenAI has soared to $500 billion in a private sale, making it the world's most valuable startup, according to financial media reports Thursday.

Investors also focused on the outlook for more Federal Reserve rate cuts, which overshadowed the closure of some US departments owing to a standoff between lawmakers in Washington.

Figures from payrolls firm ADP on Wednesday showed the US private sector shed jobs in September, despite expectations of employment growth.

"The data emboldens calls for the Fed to ease (rates) in the months ahead," said Joshua Mahony, chief market analyst at Scope Markets.

The data was the latest in a string of below-par reports indicating the labour market in the world's top economy continues to slow.

Observers said the reading had a little more significance owing to expectations that crucial non-farm payrolls statistics will not be released as usual on Friday owing to the shutdown.

"There is a risk now for market participants of a rolling data blackout that could see increased volatility," said Neil Wilson, UK investor strategist at Saxo.

All three main indexes on Wall Street rose on Wednesday, with the S&P 500 and Nasdaq hitting records.

In company news, UK supermarket Tesco climbed almost four percent in London after it lifted its profit guidance for its 2025/2026 financial year thanks to a competitive pricing strategy.

- Key figures at around 1100 GMT -

London - FTSE 100: FLAT at 9,448.08 points

Paris - CAC 40: UP 1.2 percent at 8,061.25

Frankfurt - DAX: UP 1.3 percent at 24,418.73

Tokyo - Nikkei 225: UP 0.9 percent at 44,936.73 (close)

Hong Kong - Hang Seng Index: UP 1.6 percent at 27,287.12 (close)

Shanghai - Composite: Closed for a holiday

New York - Dow: UP 0.1 percent at 46,441.10 (close)

Euro/dollar: UP at $1.1750 from $1.1728 on Wednesday

Pound/dollar: DOWN at $1.3474 from $1.3476

Dollar/yen: UP at 147.66 yen from 147.14 yen

Euro/pound: UP at 87.20 pence from 87.04 pence

West Texas Intermediate: DOWN 0.5 percent at $61.48 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $65.04 per barrel

N.Simek--TPP