RBGPF

0.1000

Wall Street stock indices pulled back from records on Wednesday ahead of key US labor data, while oil prices fell further after US President Donald Trump said Venezuela would turn over millions of barrels to the United States.

Both the Dow and S&P 500 retreated from Tuesday's all-time records as markets digested reports showing a fall in US job openings in November and a lower-than-expected rise in private-sector hiring in December.

More upbeat was a services sector survey by the Institute for Supply Management that showed healthier growth in December compared with November.

The jobs data was not great, but did not "trigger changes to perceptions about future Fed rate cuts," said Steve Sosnick of Interactive Brokers.

"We attempted to follow through from the rallies of the last couple of days, and so far we haven't been able to," Sosnick said.

The Dow finished down 0.9 percent, while the S&P 500 dropped 0.3 percent after both indices surged to new peaks amid bullish investor sentiment to start the 2026 trading year. The tech-focused Nasdaq edged up 0.2 percent.

Futures markets expect the Fed to hold interest rates steady later this month, but concerns of a sharp slowdown in hiring could prompt a rethink.

Analysts say Friday's Labor Department report for December will be a critical input to the US central bank.

In Europe, Frankfurt hit a record high above 25,000 points.

Paris traded flat and London slid from a record high set on Tuesday as lower oil prices dragged on British heavyweights BP and Shell, which both fell more than three percent.

Both main oil contracts dropped on Wednesday, having already lost ground a day earlier, after Trump's latest statement on Venezuela.

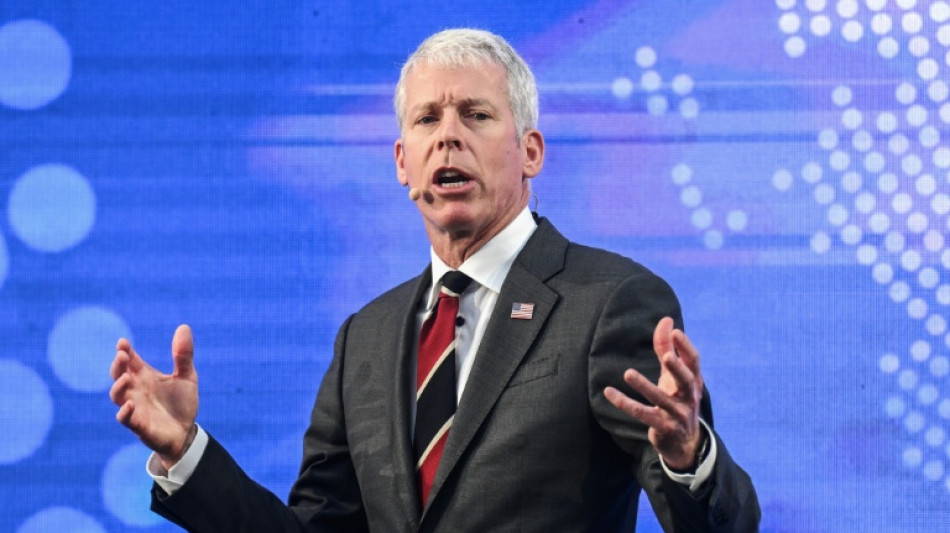

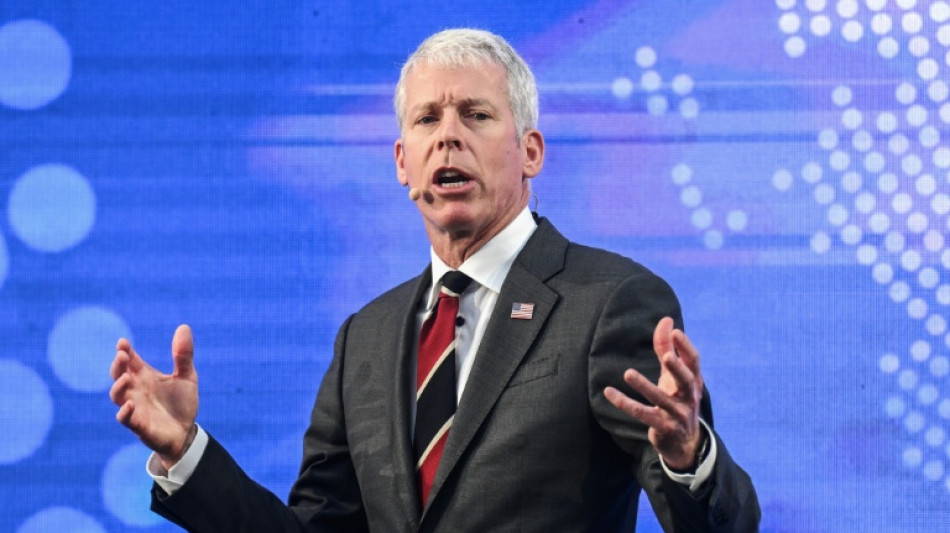

US Energy Secretary Chris Wright said Wednesday that Washington will control sales of Venezuelan oil "indefinitely". Venezuela's state petroleum firm said only that it was negotiating the sale of crude oil to the United States.

Analysts said the shipments lowered the risk that Caracas would have to cut output owing to its limited storage capacity, easing supply concerns.

But they added that the outlook for the commodity pointed to lower prices, as the market remains well stocked after OPEC+ agreed to boost output.

Elsewhere, US defense stocks tumbled after Trump threatened to cap executive pay at major US defense contractors and ban shareholder dividends and stock buybacks.

Lockheed Martin, General Dynamics and RTX all lost 2.5 percent or more.

Shares in Warner Bros. Discovery edged higher after its board urged shareholders to reject an improved hostile takeover bid by rival Paramount, saying it was still inferior to Netflix's offer.

Shares in Netflix rose a scant 0.1 percent while Paramount fell 0.9 percent.

- Key figures at around 2130 GMT -

West Texas Intermediate: DOWN 2.0 percent at $55.99 per barrel

Brent North Sea Crude: DOWN 1.2 percent at $59.96 per barrel

New York - Dow: DOWN 0.9 percent at 48,996.08 (close)

New York - S&P 500: DOWN 0.3 percent at 6,920.93 (close)

New York - Nasdaq Composite: UP 0.2 percent at 23,584.28 (close)

London - FTSE 100: DOWN 0.7 percent at 10,048.21 (close)

Paris - CAC 40: FLAT at 8,233.92 (close)

Frankfurt - DAX: UP 0.9 percent at 25,122.26 (close)

Tokyo - Nikkei 225: DOWN 1.1 percent at 51,961.98 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 26,458.95 (close)

Shanghai - Composite: UP 0.1 percent at 4,085.77 (close)

Euro/dollar: DOWN at $1.1682 from $1.1689 on Tuesday

Pound/dollar: DOWN at $1.3463 from $1.3501

Dollar/yen: UP at 156.77 yen from 156.65 yen

Euro/pound: UP at 86.76 pence from 86.57 pence

burs-jmb/aha

K.Dudek--TPP